Latest News

The Economics of Investor Confidence: Why Venture-Backed Startups Still Print Pitch Decks

Silicon Valley is fueled by digital ingenuity, but the founders of tech companies have been known to walk into offices on Sand Hill Road with printed pitch decks. Outsiders are baffled by this contradiction, but venture capitalists know something fundamental about human psychology and decision making. Physical materials are processed by the brain differently than [...]

Via Visibility · January 21, 2026

Via MarketBeat · January 22, 2026

BigBear.ai is riding the AI boom, but how the company manages these two key risks will decide whether this stock soars or stalls.

Via The Motley Fool · January 22, 2026

Nike investors have been losing big for the past few years. Is this former champion becoming a permanent underdog?

Via The Motley Fool · January 22, 2026

Amalgamated Financial Corp (NASDAQ:AMAL) Reports Mixed Q4 2025 Results with Earnings Beat and Revenue Misschartmill.com

Via Chartmill · January 22, 2026

LSI Industries Inc (NASDAQ:LYTS) Reports Mixed Q2 FY2026 Results with Revenue Beat and Strong Cash Flowchartmill.com

Via Chartmill · January 22, 2026

Huntington Bancshares Inc (NASDAQ:HBAN) Stock Falls After Q4 2025 Revenue and EPS Miss Estimateschartmill.com

Via Chartmill · January 22, 2026

OLD REPUBLIC INTL CORP (NYSE:ORI) Stock Falls 4% After Q4 Earnings Misschartmill.com

Via Chartmill · January 22, 2026

Netflix's ad revenue is soaring, but it's leaving money on the table.

Via The Motley Fool · January 22, 2026

With Sweetgreen shares 85% off their record, it's difficult to be bullish.

Via The Motley Fool · January 22, 2026

This AI power chip stock looks risky today but one NVIDIA driven catalyst could completely change its future.

Via The Motley Fool · January 22, 2026

It's a critical date to put on your calendar.

Via The Motley Fool · January 22, 2026

OFG Bancorp (NYSE:OFG) Q4 2025 Earnings Beat Estimates, Shares Risechartmill.com

Via Chartmill · January 22, 2026

Procter & Gamble Co. (NYSE:PG) Q2 2026 Earnings: Revenue Misses, EPS Meets Targetschartmill.com

Via Chartmill · January 22, 2026

QUALCOMM INC (NASDAQ:QCOM) Stands Out as a Quality Dividend Stock for Income Investorschartmill.com

Via Chartmill · January 22, 2026

Regional banking company S&T Bancorp (NASDAQ:STBA) announced better-than-expected revenue in Q4 CY2025, with sales up 10.8% year on year to $105.3 million. Its GAAP profit of $0.89 per share was 1.7% above analysts’ consensus estimates.

Via StockStory · January 22, 2026

Regional banking company Cadence Bank (NYSE:CADE) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 17.1% year on year to $528.4 million. Its non-GAAP profit of $0.85 per share was 6.4% above analysts’ consensus estimates.

Via StockStory · January 22, 2026

Investors should look at these three options as swing-for-the-fences stock picks.

Via The Motley Fool · January 22, 2026

Healthcare product and device company Abbott Laboratories (NYSE:ABT) fell short of the markets revenue expectations in Q4 CY2025 as sales rose 4.4% year on year to $11.46 billion. Its non-GAAP profit of $1.50 per share was in line with analysts’ consensus estimates.

Via StockStory · January 22, 2026

Financial services company Northern Trust (NASDAQ:NTRS) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 8.4% year on year to $2.14 billion. Its GAAP profit of $2.42 per share was 2.8% above analysts’ consensus estimates.

Via StockStory · January 22, 2026

Autonomous driving technology company Mobileye (NASDAQ:MBLY) beat Wall Street’s revenue expectations in Q4 CY2025, but sales fell by 9% year on year to $446 million. On the other hand, the company’s full-year revenue guidance of $1.94 billion at the midpoint came in 3% below analysts’ estimates. Its non-GAAP profit of $0.06 per share was in line with analysts’ consensus estimates.

Via StockStory · January 22, 2026

Some beaten-down tech stocks are broken. These two are just misunderstood.

Via The Motley Fool · January 22, 2026

Insurance conglomerate Old Republic International (NYSE:ORI) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 10.8% year on year to $2.39 billion. Its non-GAAP profit of $0.74 per share was 16.2% below analysts’ consensus estimates.

Via StockStory · January 22, 2026

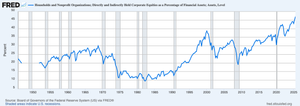

Madness and mayhem are the order of the day, while consumer and business sentiment are dour, and for-sale signs are popping up like measles.

Via Talk Markets · January 22, 2026

The bank stock has crushed the market in the past five years.

Via The Motley Fool · January 22, 2026