Bitcoin (BTCUSD) treasury and analytics company Strategy (MSTR) (formerly MicroStrategy) is making full use of the crypto winter in recent times. After pouring in more than a hundred million dollars last week, the world's largest Bitcoin treasury company added 13,627 tokens of the world's largest cryptocurrency for $1.25 billion. The average purchase price per share was $91,519 per token. With this latest purchase, Strategy now holds 687,410 coins for an average price of $75,353 per token for a total consideration of $51.8 billion.

Strategy's additions smack of an opportunistic move on the part of the company after Bitcoin has remained flat in the past year. Compared to other risk-off assets (since Bitcoin is considered digital gold), such as gold (+71.91%), silver (+193.07%), and copper (+37.83%), the underperformance could not have been starker. This came about even though perceived tailwinds such as rising geopolitical tensions, de-dollarization efforts around the world, and global central banks' shift from the dollar as a haven became stronger trends over the last years.

Amid all this, Strategy remains wildly optimistic about the cryptocurrency, with CEO Michael Saylor expecting it to hit a whopping $1 million per token mark by 2029. This means a more than tenfold jump in three years.

So, should investors set sail on Saylor's Bitcoin boat and add the MSTR stock to their portfolio, or should they give it a pass? Let's find out.

Steady Financials Headlined by Bitcoin Holdings

Strategy commands a market cap of $46.6 billion, while its shares are down 46% over the past year, which undervalues the company, I think, considering its digital assets haul is itself at $73.2 billion. Moreover, Strategy also has a cash balance of $54.3 million as of the end of the September 2025 quarter.

Additionally, as of Oct. 26, 2025, Strategy's BTC yield stood at 26%, higher than the previous year's figure of 17.8%. Further, the number of Bitcoins held by the company increased as well to 640,808 (as of Oct. 26, 2025) from 252,220 (as of Sept. 30, 2024).

The software business, which has been its secondary segment for a while now, also saw growth. In Q3 2025, total revenues rose by 11% from the prior year to $128.7 million. Within this, the largest segment of product licenses and subscription services moved higher by 63% in the same period to $63.3 million.

Further, at just $316,000, the company's short-term debt levels were much lower than its cash balance, let alone its digital assets balance, allaying any liquidity fears.

Overall, Strategy is aiming for a BTC yield of 30% and a gain in value of BTC for the year of $20 billion in 2025.

Strategy's… Strategy for Growth

Strategy’s core growth strategy centers on steadily increasing Bitcoin exposure on a per-share basis by raising capital through a combination of equity and debt issuances, with proceeds directed toward additional BTC acquisitions. This approach effectively positions the company as a scaled, publicly listed vehicle for Bitcoin treasury management. In 2025, the company and market discussions frequently referenced the “21/21 Plan,” a multi-year framework aiming to secure $21 billion in equity capital and $21 billion in debt to fund further Bitcoin accumulation while opportunistically tapping markets when financing costs remain attractive.

A central element of this strategy is what CEO Michael Saylor terms the “digital credit factory.” This involves transforming volatile Bitcoin holdings into a suite of structured financial products, each carrying distinct risk-return characteristics. The company’s operational framework functions as a self-reinforcing cycle, with tax treatment playing a pivotal role in enhancing its appeal and supporting growth. Preferred equity instruments, among other offerings, help mitigate Bitcoin’s price volatility. Proceeds from these instruments are then redeployed into additional Bitcoin purchases.

A further benefit lies in the tax-deferred characteristics embedded in the model. Preferred dividends are tax-deferred, Bitcoin purchases and holdings generate no immediate tax liability, and shareholder capital appreciation remains tax-deferred until realization.

Conversely, the company has not abandoned its legacy software business. While Bitcoin drives the majority of value, management continues to position the core analytics platform as an industry-leading, AI-powered enterprise solution capable of generating recurring revenue to offset corporate overhead. This framing positions the software operations as a credible, ongoing business engine supporting the broader Bitcoin treasury strategy.

Challenges persist, however. Growing competition has emerged, with several firms rebranding as crypto treasury vehicles, increasing pressure on capital access, and raising the cost of funding.

Dilution risk also remains significant. Convertible notes introduce asymmetric outcomes for common shareholders: strong stock performance triggers dilution through conversion, while weak performance avoids dilution but elevates leverage and refinancing risk. These dynamics embed dilution directly into the strategy and amplify downside exposure should Bitcoin enter a prolonged downturn or the net asset value premium compress materially.

Analyst Opinion on MSTR Stock

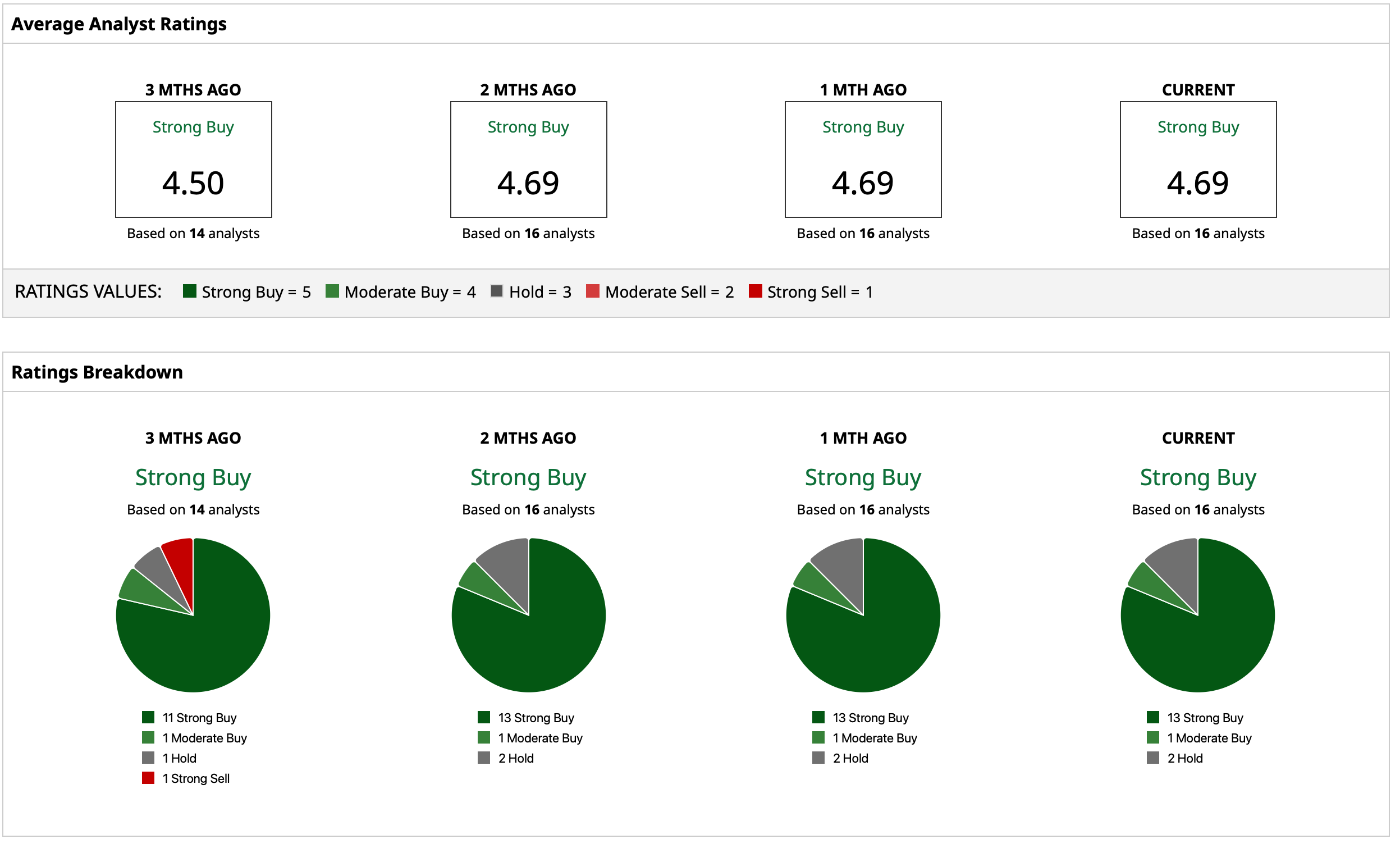

Thus, analysts have attributed a rating of “Strong Buy” for the stock, with a mean target price of $473.79, which denotes a hefty upside potential of about 174% from current levels. Out of 16 analysts covering the stock, 13 have a “Strong Buy” rating, one has a “Moderate Buy” rating, and two have a “Hold” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- MicroStrategy Just Exponentially Increased Its Bitcoin Purchases. What Does That Mean for MSTR Stock?

- The Market Is Stress Testing Crypto. This 1 ETF Is a Tactical, High-Risk Way to Bet on Its Comeback.

- Down 45% From Its Highs, This Analyst Thinks You Should Buy the Dip in Coinbase Stock

- MicroStrategy Gets to Stay in MSCI Indexes. Is That Win Enough to Keep Buying MSTR Stock in 2026?