- IQST Delivers Diversified Business with Divisions Focused on Telecommunications, Fintech, Electric Vehicles, Artificial Intelligence and More.

- Partnership with Call Center in U.S. Health Services to Implement Next-Generation AI Solutions Using IQST Proprietary AI Technology.

- 2025 Plan Toward $15 Million EBITDA Run Rate in 2026 and $1 Billion Revenue Goal in 2027.

- Fintech Division Accelerates EBITDA Growth with Globetopper Contribution.

- IQST and CYCU Execute $1 Million Stock Exchange, Announce Dividend Distribution and Strategic AI Cybersecurity Alliance.

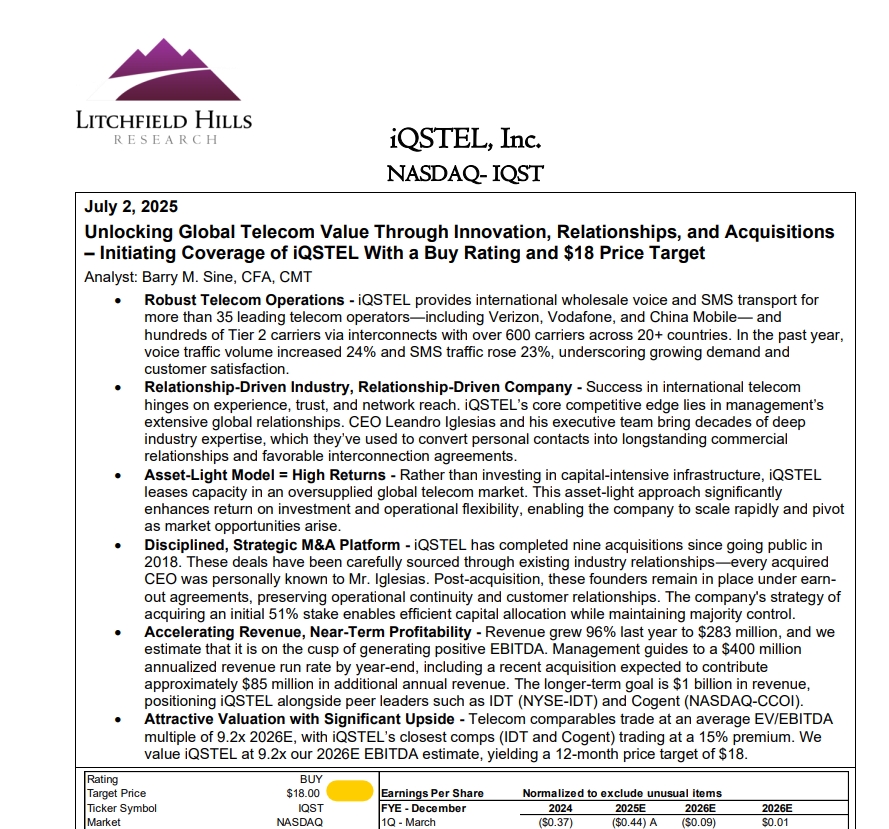

- Litchfield Hills Research Issues Recommendation and Detailed Report on IQSTEL (IQST) with $18 Price Target.

- $430 Million Organic Revenue Forecast for 2026, Reflecting 26% Organic Growth and Building on Strong Momentum.

- Completed Phase One of Next-Generation Cyber Defense Rollout with CYCU Partner Company.

- Debt-Free Nasdaq Company with No Convertible Notes or Warrants and Plans to Give $500,000 in Shares as Dividend by the End of the Year.

- Q2 Results: $17.41 Assets Per Share, Beating Metrics Including Net Shareholders' Equity, Gross Revenue, Gross Margin, Net Income, and Adjusted EBITDA

- Launch of IQ2Call, Delivering Vertical AI-Telecom Integration to Target the $750B Global Market.

- Equity Position Strengthened with $6.9 Million Debt Cut -- Almost $2 Per Share.

IQSTEL, Inc. (Nasdaq: IQST) offers cutting-edge solutions in Telecom, Fintech, Blockchain, Artificial Intelligence (AI), and Cybersecurity. Operating in 21 countries, IQST delivers high-value, high-margin services to its extensive global customer base. IQST projects $340 million in revenue for FY-2025, building on its strong business platform.

IQST has been building a strong business platform with its customers, selling them millions of dollars per month, and by leveraging this trust, the company is now beginning to sell high-tech, high-margin products across its divisions. IQST is strategically positioned to achieve $1 billion in revenue by 2027 through organic growth, acquisitions, and high-margin product expansion.

Fintech Division Accelerates EBITDA Growth with Globetopper Contribution

On September 16th IQST announced that its Fintech Division is positioned to play a key role in achieving the Company's goal of reaching a $15 million EBITDA run rate in 2026.

IQST completed the acquisition of Globetopper on July 1, 2025, and has since been accelerating its growth as part of the Company's strategic roadmap. Globetopper is expected to contribute approximately $16 million in Q3 2025 revenue and deliver $110,000 in EBITDA, making it cash flow positive for the quarter.

IQST plans to leverage its business platform — which already reaches over 600 of the largest telecom operators worldwide — to offer Globetopper's fintech services directly to its telecom customers.

$430 Million Organic Revenue Forecast for 2026, Reflecting 26% Organic Growth

On October 30th IQST announced its 2026 organic revenue forecast of $430 million, representing a 26% increase over the company’s $340 million revenue forecast for 2025.

IQST reported $283 million in revenue for fiscal year 2024 and has reaffirmed that it remains on track to meet its $340 million 2025 forecast, driven by continued organic expansion across its Telecom, Fintech, Artificial Intelligence (AI), and Cybersecurity services.

IQST has built a strong track record of meeting or exceeding its financial forecasts, demonstrating consistent execution and disciplined management across its diversified operations.

IQST also reiterated its strategic plan to acquire two to three accretive businesses as part of its roadmap to achieve $15 million in EBITDA by 2026, while maintaining a clear focus on profitable organic growth. Once IQST completes any of its potential acquisition targets, the Company plans to update the 2026 revenue forecast accordingly.

IQST and CYCU Enter a New Era of AI-Cybersecurity, Completing Phase One of Their Next-Generation Cyber Defense Rollout

IQSTEL's Reality Border and Cycurion Join Forces to Deliver AI Agents with Built-In Cyber Defense and Proactive Threat Hunting Capabilities — Marking the First Step Toward Building the Industry's Most Secure AI Ecosystem for Global Telecom and Enterprise Clients

On October 21st IQST announced that Reality Border, its AI subsidiary, has completed Phase One of its joint program with Cycurion, Inc. (NASDAQ: CYCU) to deliver a new generation of AI-enhanced cybersecurity. The milestone introduces a secure Model Context Protocol (MCP) integration for Airweb.ai (web AI agent) and IQ2Call.ai (voice AI agent), now fronted and protected by Cycurion's ARx multi-layer cybersecurity platform.

IQST Becomes a Debt-Free Nasdaq Company with No Convertible Notes or Warrants and Plans to Give $500,000 in Shares as Dividend by the End of the Year

On October 9th IQST announced it has eliminated all convertible notes from its balance sheet and fully paid for its most recent acquisitions, QXTEL and Globetopper.

With this achievement, IQST has officially become a debt-free company — with no convertible notes and no warrants outstanding — reinforcing its solid financial foundation and long-term commitment to creating shareholder value. IQST stands out with $17.41 in assets per share and a clean capital structure with zero convertible debt and no warrants outstanding.

In conjunction with this financial progress, IQST plans to distribute a $500,000 dividend in shares before the end of 2025, as part of its strategic partnership with Cycurion (CYCU).

Through this partnership, IQST has entered the cybersecurity arena with a trusted U.S. government-certified technology provider, expanding its portfolio of Telecom, Fintech, AI, and Digital services.

To enhance transparency and provide easy access to corporate updates, IQST has launched its official Investors Landing Page, a dedicated portal summarizing key financial metrics, strategic milestones, and news updates. Visit: www.landingpage.iqstel.com

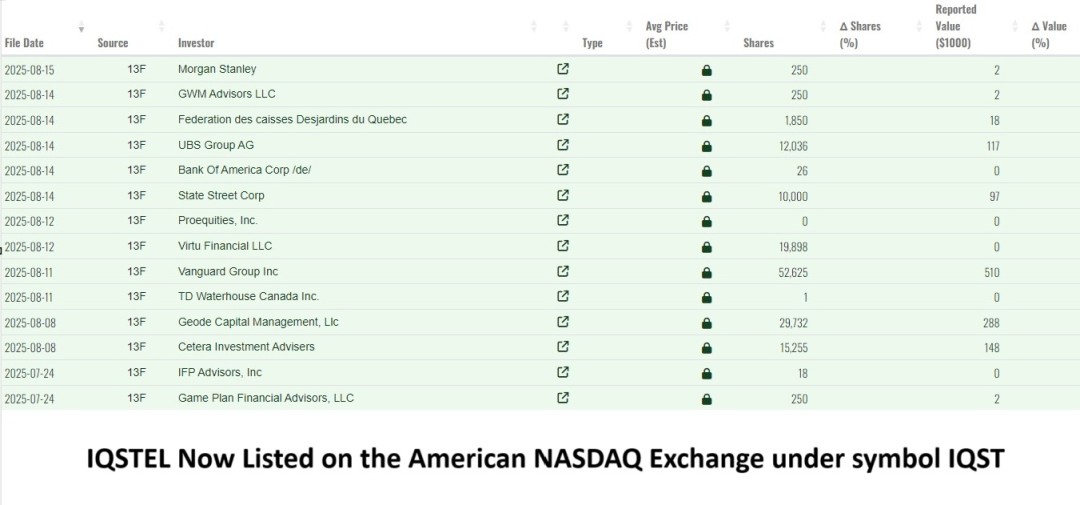

IQST Celebrates 120 Days on Nasdaq with Institutional Investors, Analyst Coverage, and Cycurion Dividend Driving AI & Digital Expansion

On September 24th IQST announced the release of its 120-Day Nasdaq Shareholder Letter, highlighting the Company's performance, growth trajectory, and increasing institutional recognition since uplisting to Nasdaq. The letter included these highlights:

Diversified Growth – Four strategic business lines: Telecommunications, Fintech, Artificial Intelligence, and Cybersecurity.

Global Reach – Operations in 20+ countries, with commercial relationships spanning 600+ of the world's largest telecom operators.

High-Margin Expansion – A powerful platform to layer in additional services, including AI, fintech, and cybersecurity solutions — highlighted by our partnership with Cycurion (CYCU).

Intelligence Momentum – The IQST Intelligence division is growing faster than expected. Highlights include the ONAR partnership, the Mobility Tech partnership, the Cycurion alliance, plus three more contracts in the sales funnel, expected to close before year-end.

Strong Financial Trajectory – On track toward $1 billion in revenue by 2027, with a projected $15M EBITDA run rate in 2026.

Institutional Confidence – Approximately 12 institutional investors now hold 4% of IQST shares, just 120 days after our Nasdaq uplisting.

Research Recognition – Litchfield Hills Research issued a detailed report with an $18 price target: https://shre.ink/te9s

Momentum in Q2 & Q3 – $35M revenue in July, surpassing a $400M annual run rate five months ahead of schedule. Assets per share stand at $17.41, outperforming across net equity, gross revenue, margins, net income, and adjusted EBITDA.

Strategic Alliances – IQST and CYCU executed a $1M stock exchange and dividend distribution, with IQST planning to distribute $500,000 in CYCU Nasdaq shares to its shareholders as part of the partnership.

Innovation in AI – Launch of www.IQ2Call.ai, targeting the $750B global market with vertical AI-Telecom integration, including next-gen AI for U.S. healthcare call centers.

Fintech Acceleration – Acquisition of Globetopper (July 1, 2025), forecasted to add $34M revenue and positive EBITDA in H2 2025.

Balance Sheet Strength – $6.9M debt reduction (~$2 per share), reinforcing our equity position. Notably, half of this debt was voluntarily converted by investors into Preferred Shares, underscoring their trust in IQSTEL's vision, management, and growth strategy.

Revenue Mix – Current revenue stream: 80% telecommunications, 20% fintech, with fintech and AI & Digital services set to accelerate growth.

Watch CEO Leandro Iglesias share his vision for IQST growth: https://acortar.link/st2ZLb

For more information on $IQST visit: www.IQSTEL.com and www.landingpage.iqstel.com

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Media Contact

Company Name: IQSTEL Inc.

Contact Person: Leandro Jose Iglesias, President and CEO

Email: Send Email

Phone: +1 954-951-8191

Address:300 Aragon Avenue Suite 375

City: Coral Gables

State: Florida 33134

Country: United States

Website: www.iQSTEL.com