Independent financial services firm LPL Financial (NASDAQ:LPLA) announced better-than-expected revenue in Q3 CY2025, with sales up 48.4% year on year to $4.55 billion. Its non-GAAP profit of $5.20 per share was 15.8% above analysts’ consensus estimates.

Is now the time to buy LPL Financial? Find out by accessing our full research report, it’s free for active Edge members.

LPL Financial (LPLA) Q3 CY2025 Highlights:

- Assets Under Management: $2.3 trillion vs analyst estimates of $2.12 trillion (48.9% year-on-year growth, 8.5% beat)

- Revenue: $4.55 billion vs analyst estimates of $4.34 billion (48.4% year-on-year growth, 5% beat)

- Pre-tax Profit: -$34.11 million (-0.7% margin, 110% year-on-year decline)

- Adjusted EPS: $5.20 vs analyst estimates of $4.49 (15.8% beat)

- Market Capitalization: $27.49 billion

"Over the past quarter, we continued to make progress against our key priorities, while delivering strong business results and record adjusted earnings per share," said Rich Steinmeier, CEO.

Company Overview

As the nation's largest independent broker-dealer with no proprietary products of its own, LPL Financial (NASDAQ:LPLA) provides technology, compliance, and business support services to independent financial advisors and institutions who manage investments for retail clients.

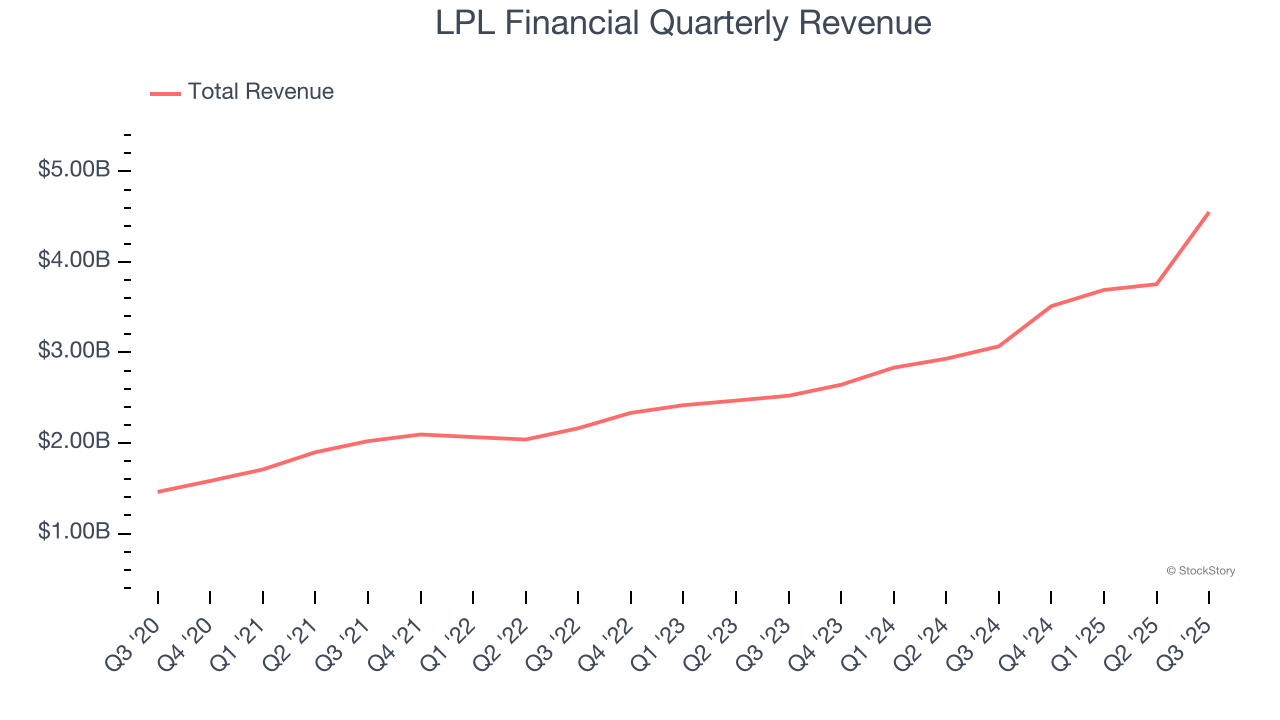

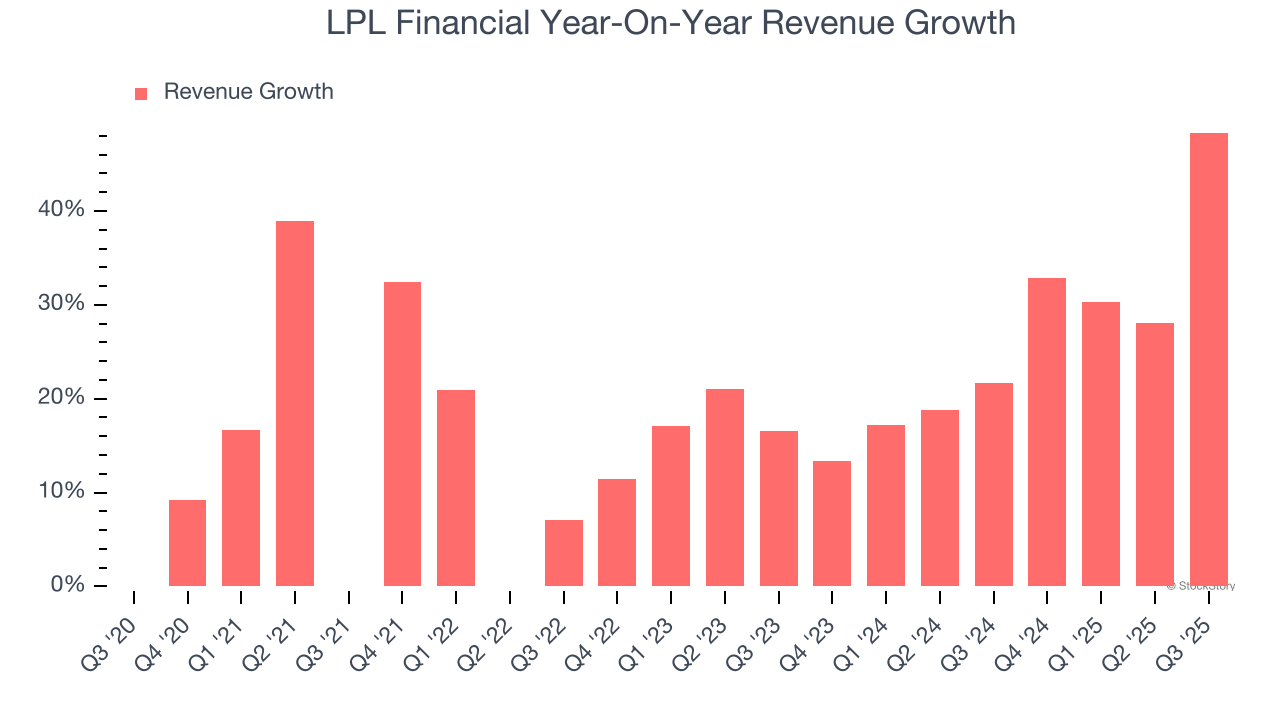

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, LPL Financial grew its revenue at an exceptional 22% compounded annual growth rate. Its growth surpassed the average financials company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. LPL Financial’s annualized revenue growth of 26.2% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, LPL Financial reported magnificent year-on-year revenue growth of 48.4%, and its $4.55 billion of revenue beat Wall Street’s estimates by 5%.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

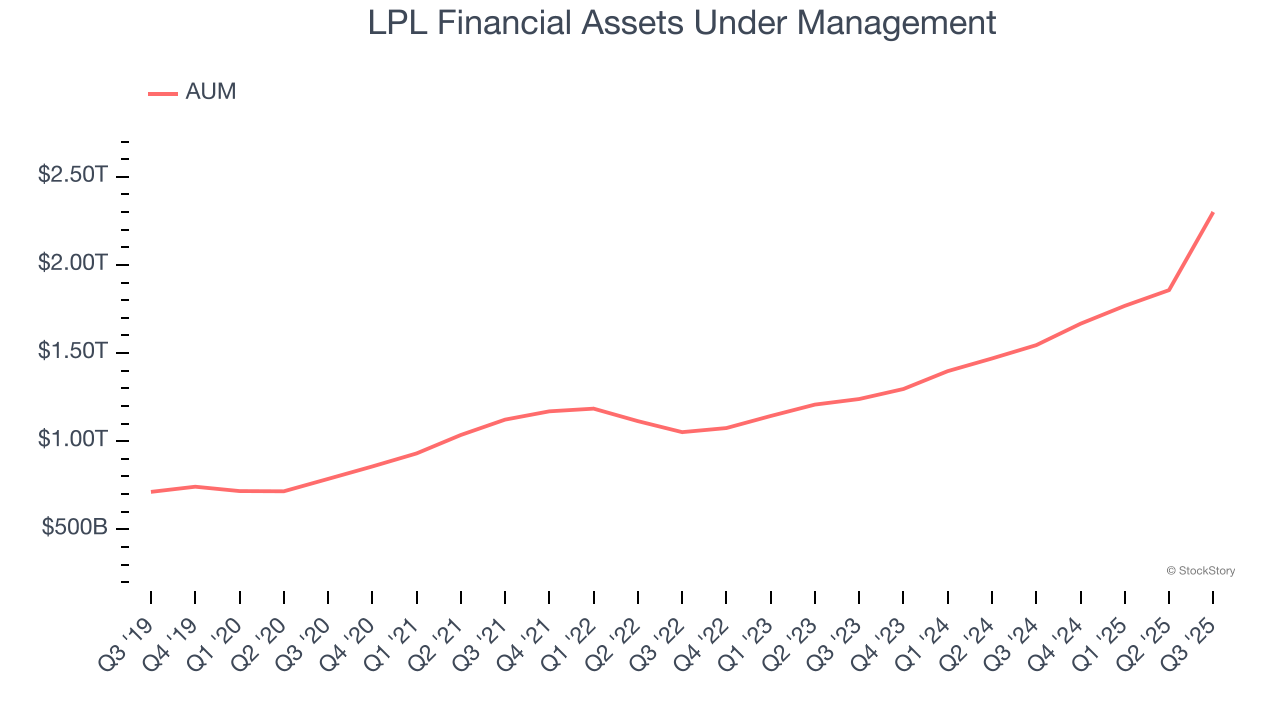

Assets Under Management (AUM)

Assets Under Management (AUM) is the total capital a firm oversees or manages on behalf of clients. Fees on this AUM, typically a small percentage, are contractually recurring and provide a high level of stability to revenue even if investment performance lags (although too much poor investment performance eventually hurts fundraising ability).

LPL Financial’s AUM has grown at an annual rate of 20.7% over the last five years, better than the broader financials industry but slower than its total revenue. When analyzing LPL Financial’s AUM over the last two years, we can see that growth accelerated to 27.6% annually. Fundraising or short-term investment performance were net contributors for the company over this shorter period since assets grew faster than total revenue. Keep in mind that asset growth can be erratic and seasonal, so we don't rely on it too heavily for our business quality analysis.

In Q3, LPL Financial’s AUM was $2.3 trillion, beating analysts’ expectations by 8.5%. This print was 48.9% higher than the same quarter last year.

Key Takeaways from LPL Financial’s Q3 Results

We were impressed by how significantly LPL Financial blew past analysts’ AUM expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock traded up 1.3% to $344 immediately following the results.

LPL Financial may have had a good quarter, but does that mean you should invest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.