As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q4. Today, we are looking at aerospace and defense stocks, starting with Axon (NASDAQ:AXON).

Emissions and automation are important in aerospace, so companies that boast advances in these areas can take market share. On the defense side, geopolitical tensions–whether it be Russia’s invasion of Ukraine or China’s aggression toward Taiwan–have highlighted the need for consistent or even elevated defense spending. As for challenges, demand for aerospace and defense products can ebb and flow with economic cycles and national defense budgets, which are unpredictable and particularly painful for companies with high fixed costs.

The 31 aerospace and defense stocks we track reported a satisfactory Q4. As a group, revenues beat analysts’ consensus estimates by 1.6% while next quarter’s revenue guidance was 1.8% above.

While some aerospace and defense stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 2.8% since the latest earnings results.

Axon (NASDAQ:AXON)

Providing body cameras and tasers for first responders, AXON (NASDAQ:AXON) develops technology solutions and weapons products for military, law enforcement, and civilians.

Axon reported revenues of $575.1 million, up 33.6% year on year. This print exceeded analysts’ expectations by 1.5%. Overall, it was an exceptional quarter for the company with an impressive beat of analysts’ sales volume estimates and a solid beat of analysts’ EPS estimates.

The stock is up 11.5% since reporting and currently trades at $555.

Best Q4: Mercury Systems (NASDAQ:MRCY)

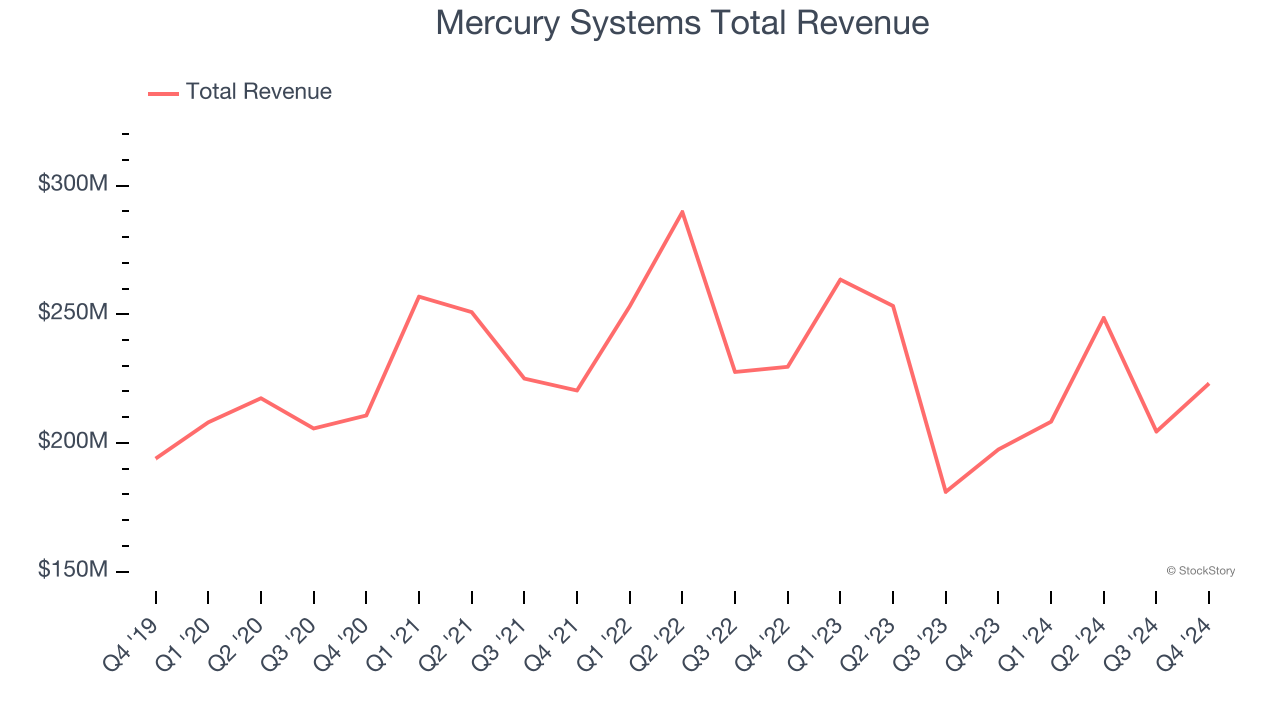

Founded in 1981, Mercury Systems (NASDAQ:MRCY) specializes in providing processing subsystems and components for primarily defense applications.

Mercury Systems reported revenues of $223.1 million, up 13% year on year, outperforming analysts’ expectations by 23.9%. The business had an incredible quarter with a solid beat of analysts’ organic revenue estimates and an impressive beat of analysts’ EPS estimates.

Mercury Systems pulled off the biggest analyst estimates beat among its peers. Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 1.5% since reporting. It currently trades at $41.47.

Is now the time to buy Mercury Systems? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: AeroVironment (NASDAQ:AVAV)

Focused on the future of autonomous military combat, AeroVironment (NASDAQ:AVAV) specializes in advanced unmanned aircraft systems and electric vehicle charging solutions.

AeroVironment reported revenues of $167.6 million, down 10.2% year on year, falling short of analysts’ expectations by 10.9%. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectations.

AeroVironment delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 14.5% since the results and currently trades at $121.53.

Read our full analysis of AeroVironment’s results here.

Northrop Grumman (NYSE:NOC)

Responsible for the development of the first stealth bomber, Northrop Grumman (NYSE:NOC) specializes in providing aerospace, defense, and security solutions for various industry applications.

Northrop Grumman reported revenues of $10.69 billion, flat year on year. This number missed analysts’ expectations by 2.7%. Overall, it was a slower quarter as it also recorded a miss of analysts’ organic revenue estimates and full-year revenue guidance slightly missing analysts’ expectations.

The stock is down 1.6% since reporting and currently trades at $473.56.

Read our full, actionable report on Northrop Grumman here, it’s free.

HEICO (NYSE:HEI)

Founded in 1957, HEICO (NYSE:HEI) manufactures and services aerospace and electronic components for commercial aviation, defense, space, and other industries.

HEICO reported revenues of $1.03 billion, up 14.9% year on year. This result topped analysts’ expectations by 5.4%. Overall, it was an incredible quarter as it also logged an impressive beat of analysts’ organic revenue estimates and a solid beat of analysts’ EPS estimates.

The stock is up 10.3% since reporting and currently trades at $251.31.

Read our full, actionable report on HEICO here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.