Wrapping up Q4 earnings, we look at the numbers and key takeaways for the data & business process services stocks, including Equifax (NYSE:EFX) and its peers.

A combination of increasing reliance on data and analytics across various industries and the desire for cost efficiency through outsourcing could mean that companies in this space gain. As functions such as payroll, HR, and credit risk assessment rely on more digitization, key players in the data & business process services industry could be increased demand. On the other hand, the sector faces headwinds from growing regulatory scrutiny on data privacy and security, with laws like GDPR and evolving U.S. regulations potentially limiting data collection and monetization strategies. Additionally, rising cyber threats pose risks to firms handling sensitive personal and financial information, creating outsized headline risk when things go wrong in this area.

The 9 data & business process services stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 0.5% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 7.6% since the latest earnings results.

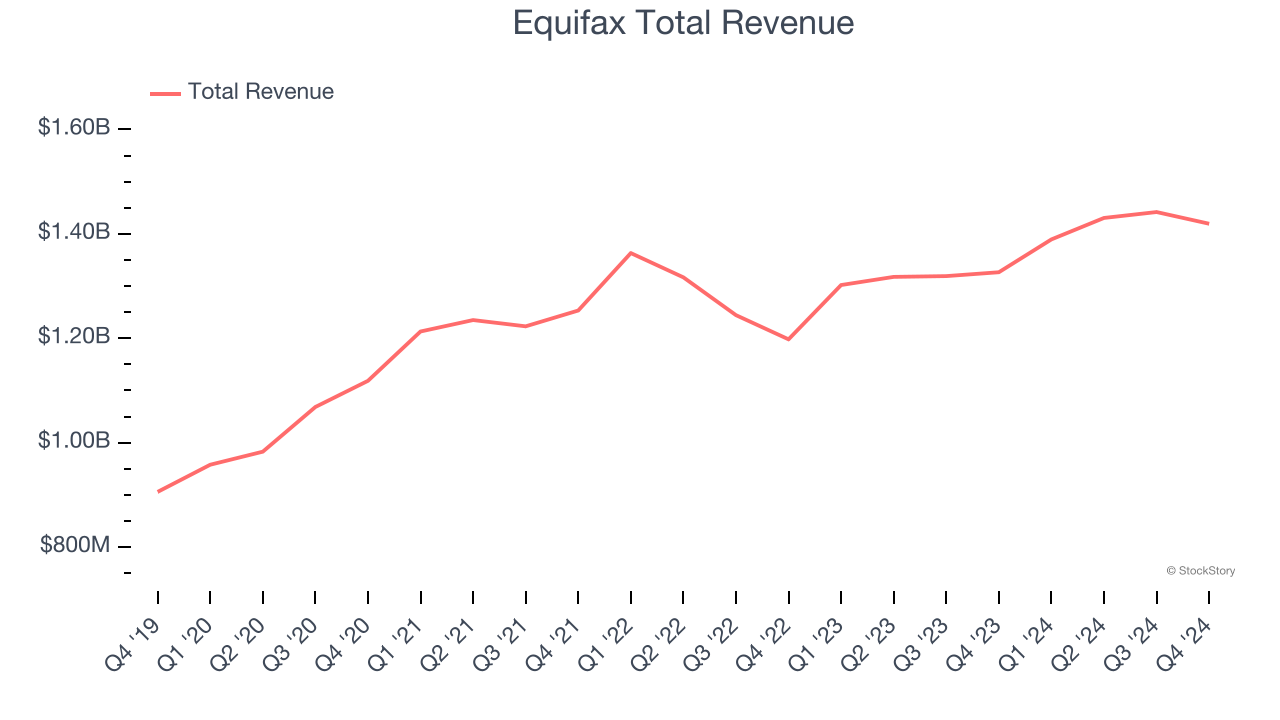

Equifax (NYSE:EFX)

Holding detailed financial records on over 800 million consumers worldwide and dating back to 1899, Equifax (NYSE:EFX) is a global data analytics company that collects, analyzes, and sells consumer and business credit information to lenders, employers, and other businesses.

Equifax reported revenues of $1.42 billion, up 7% year on year. This print fell short of analysts’ expectations by 1.4%. Overall, it was a softer quarter for the company with revenue guidance for next quarter slightly missing analysts’ expectations.

Equifax delivered the weakest full-year guidance update of the whole group. The stock is down 13.3% since reporting and currently trades at $234.31.

Read our full report on Equifax here, it’s free.

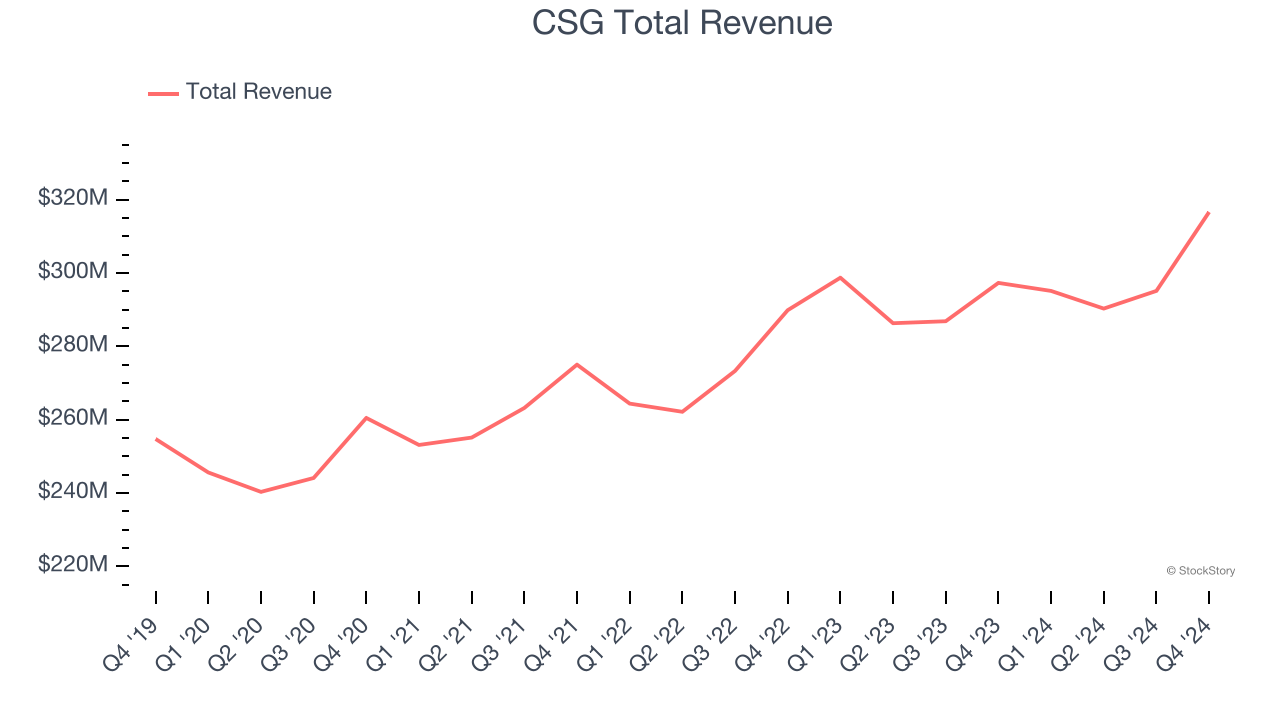

Best Q4: CSG (NASDAQ:CSGS)

Powering billions of critical customer interactions annually, CSG Systems (NASDAQ:CSGS) provides cloud-based software platforms that help companies manage customer interactions, process payments, and monetize their services.

CSG reported revenues of $316.7 million, up 6.5% year on year, in line with analysts’ expectations. The business had an exceptional quarter with an impressive beat of analysts’ EPS estimates and full-year revenue guidance exceeding analysts’ expectations.

CSG scored the highest full-year guidance raise among its peers. Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 1.8% since reporting. It currently trades at $59.76.

Is now the time to buy CSG? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Dun & Bradstreet (NYSE:DNB)

Known for its proprietary D-U-N-S Number that serves as a unique identifier for businesses worldwide, Dun & Bradstreet (NYSE:DNB) provides business decisioning data and analytics that help companies evaluate credit risks, verify suppliers, enhance sales productivity, and gain market visibility.

Dun & Bradstreet reported revenues of $631.9 million, flat year on year, falling short of analysts’ expectations by 4%. It was a disappointing quarter as it posted a significant miss of analysts’ full-year EPS guidance estimates.

Dun & Bradstreet delivered the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 23.2% since the results and currently trades at $8.06.

Read our full analysis of Dun & Bradstreet’s results here.

TransUnion (NYSE:TRU)

One of the three major credit bureaus in the United States alongside Equifax and Experian, TransUnion (NYSE:TRU) is a global information and insights company that provides credit reports, fraud prevention tools, and data analytics to help businesses make decisions and consumers manage their financial health.

TransUnion reported revenues of $1.04 billion, up 8.6% year on year. This number topped analysts’ expectations by 1%. Taking a step back, it was a softer quarter as it recorded a significant miss of analysts’ EPS guidance for next quarter estimates and revenue guidance for next quarter meeting analysts’ expectations.

The stock is down 12.9% since reporting and currently trades at $81.41.

Read our full, actionable report on TransUnion here, it’s free.

Verisk (NASDAQ:VRSK)

Processing over 2.8 billion insurance transaction records annually through one of the world's largest private databases, Verisk Analytics (NASDAQ:VRSK) provides data, analytics, and technology solutions that help insurance companies assess risk, detect fraud, and make better business decisions.

Verisk reported revenues of $735.6 million, up 8.6% year on year. This result met analysts’ expectations. However, it was a slower quarter, with full-year revenue and EPS guidance missing analysts’ expectations.

The stock is down 4.1% since reporting and currently trades at $287.01.

Read our full, actionable report on Verisk here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.