Government IT services provider Science Applications International Corporation (NASDAQ:SAIC) reported Q4 CY2024 results topping the market’s revenue expectations, with sales up 5.8% year on year to $1.84 billion. The company expects the full year’s revenue to be around $7.68 billion, close to analysts’ estimates. Its non-GAAP profit of $2.57 per share was 23.2% above analysts’ consensus estimates.

Is now the time to buy SAIC? Find out by accessing our full research report, it’s free.

SAIC (SAIC) Q4 CY2024 Highlights:

- Revenue: $1.84 billion vs analyst estimates of $1.81 billion (5.8% year-on-year growth, 1.4% beat)

- Adjusted EPS: $2.57 vs analyst estimates of $2.09 (23.2% beat)

- Adjusted EBITDA: $177 million vs analyst estimates of $160.4 million (9.6% margin, 10.3% beat)

- Management’s revenue guidance for the upcoming financial year 2026 is $7.68 billion at the midpoint, in line with analyst expectations and implying 2.6% growth (vs 0.8% in FY2025)

- Adjusted EPS guidance for the upcoming financial year 2026 is $9.20 at the midpoint, beating analyst estimates by 1.3%

- EBITDA guidance for the upcoming financial year 2026 is $725 million at the midpoint, above analyst estimates of $716.5 million

- Operating Margin: 7.5%, up from 4.5% in the same quarter last year

- Free Cash Flow Margin: 12.8%, up from 6.9% in the same quarter last year

- Backlog: $21.86 billion at quarter end

- Market Capitalization: $5.10 billion

Company Overview

With over five decades of experience supporting national security missions, Science Applications International Corporation (NASDAQ:SAIC) provides technical, engineering, and enterprise IT services primarily to U.S. government agencies and military branches.

Government & Technical Consulting

The sector has historically benefitted from steady government spending on defense, infrastructure, and regulatory compliance, providing firms long-term contract stability. However, the Trump administration is showing more willingness than previous administrations to upend government spending and bloat. Whether or not defense budgets get cut, the rising demand for cybersecurity, AI-driven defense solutions, and sustainability consulting should benefit the sector for years, as agencies and enterprises seek expertise in navigating complex technology and regulations. Additionally, industrial automation and digital engineering are driving efficiency gains in infrastructure and technical consulting projects, which could help profit margins.

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $7.48 billion in revenue over the past 12 months, SAIC is one of the larger companies in the business services industry and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because it’s harder to find incremental growth when you’ve penetrated most of the market. To accelerate sales, SAIC likely needs to optimize its pricing or lean into new offerings and international expansion.

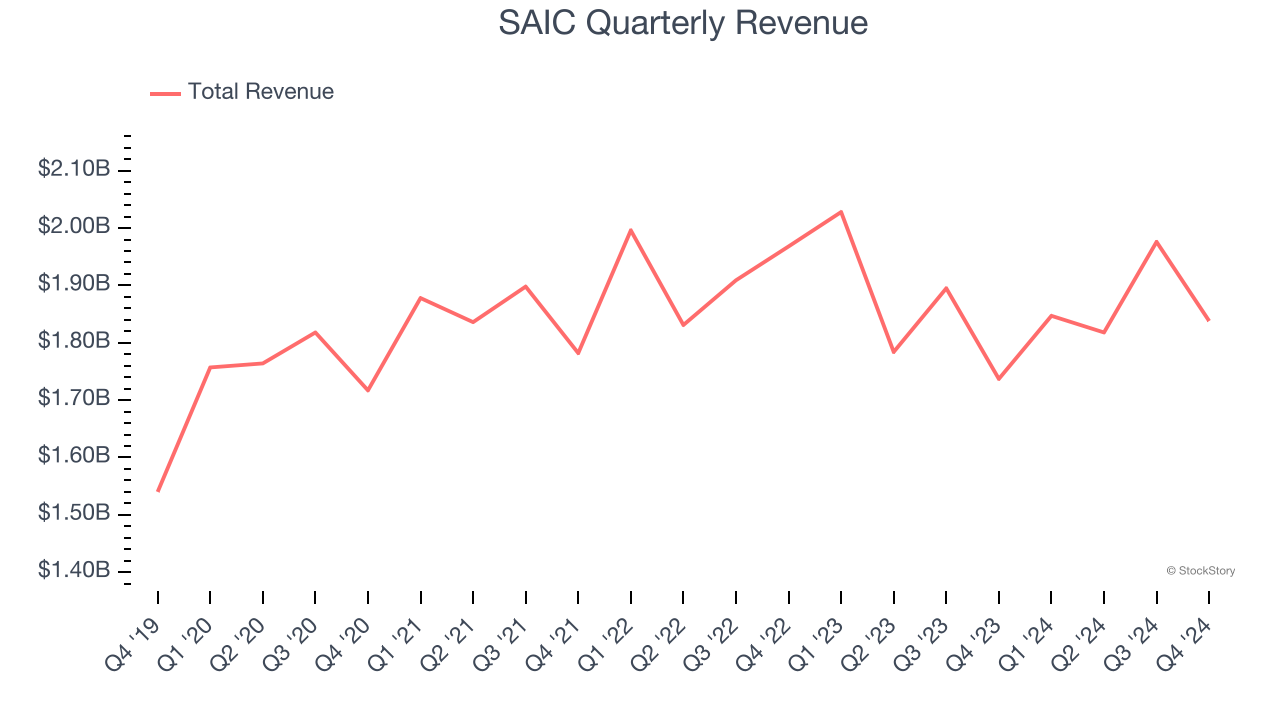

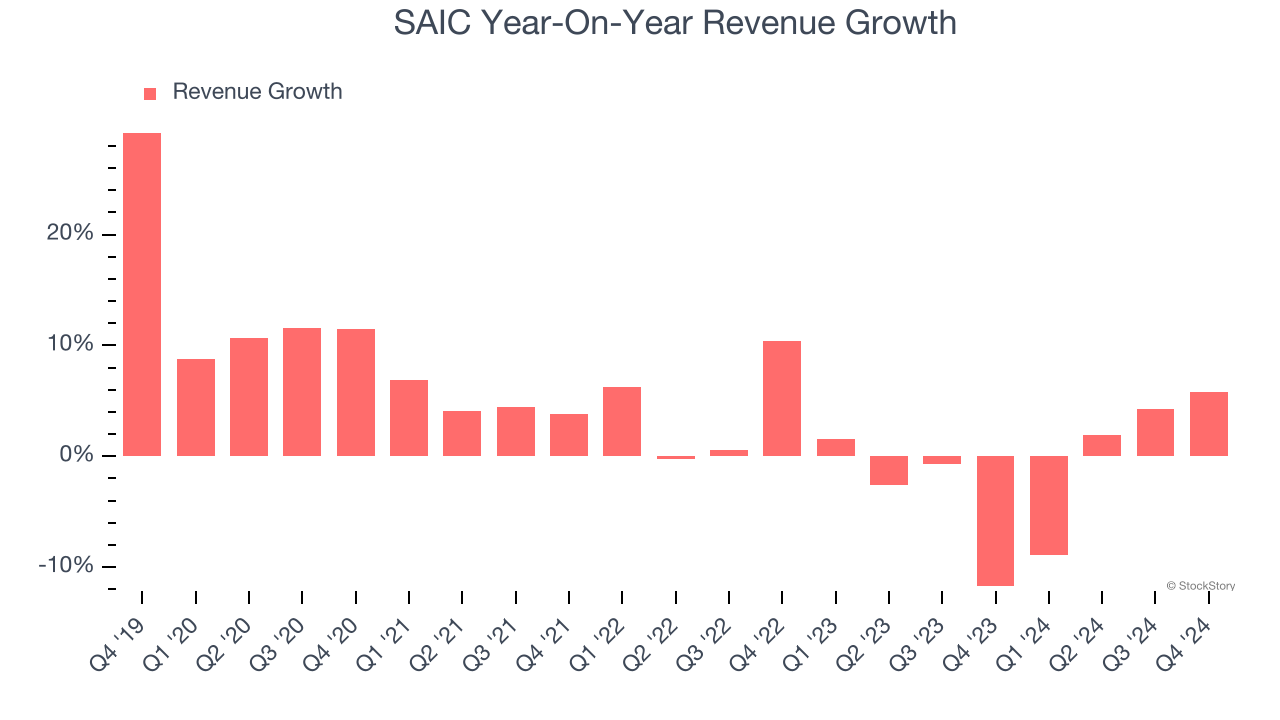

As you can see below, SAIC’s 3.2% annualized revenue growth over the last five years was tepid. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. SAIC’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 1.5% annually.

This quarter, SAIC reported year-on-year revenue growth of 5.8%, and its $1.84 billion of revenue exceeded Wall Street’s estimates by 1.4%.

Looking ahead, sell-side analysts expect revenue to grow 2.1% over the next 12 months. Although this projection indicates its newer products and services will fuel better top-line performance, it is still below the sector average.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

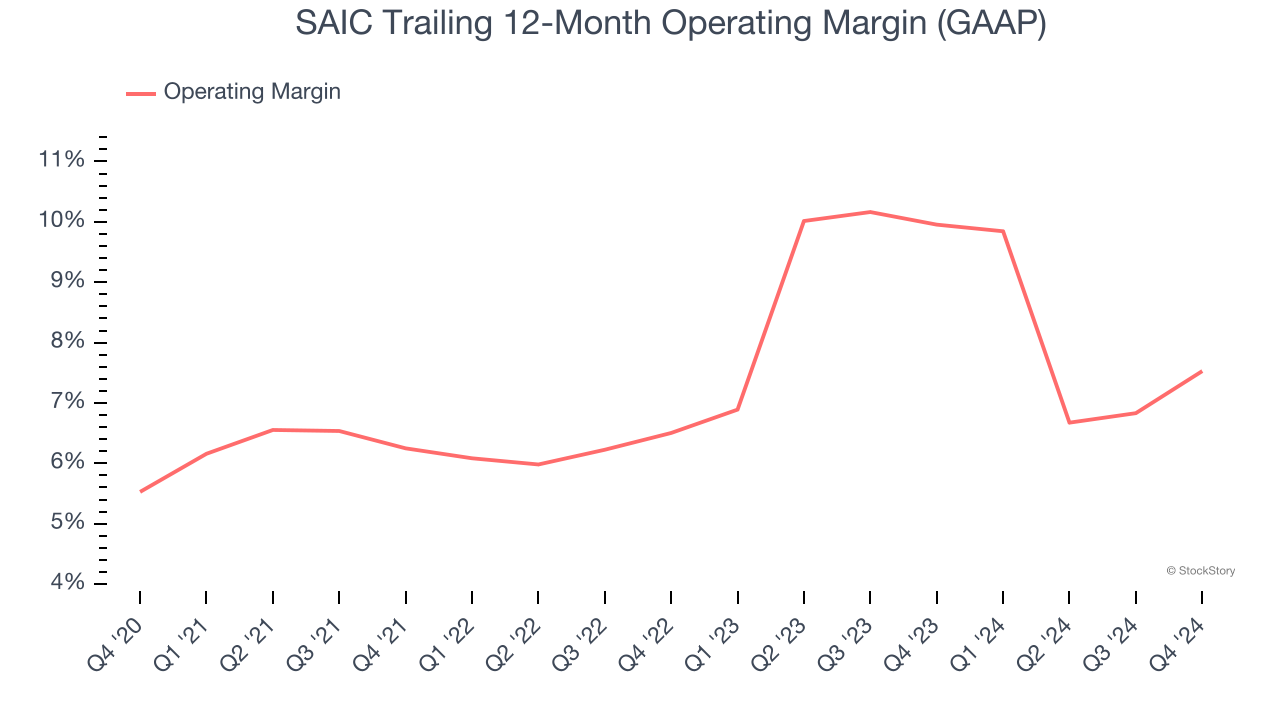

SAIC was profitable over the last five years but held back by its large cost base. Its average operating margin of 7.2% was weak for a business services business.

On the plus side, SAIC’s operating margin rose by 2 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q4, SAIC generated an operating profit margin of 7.5%, up 3 percentage points year on year. This increase was a welcome development and shows it was more efficient.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

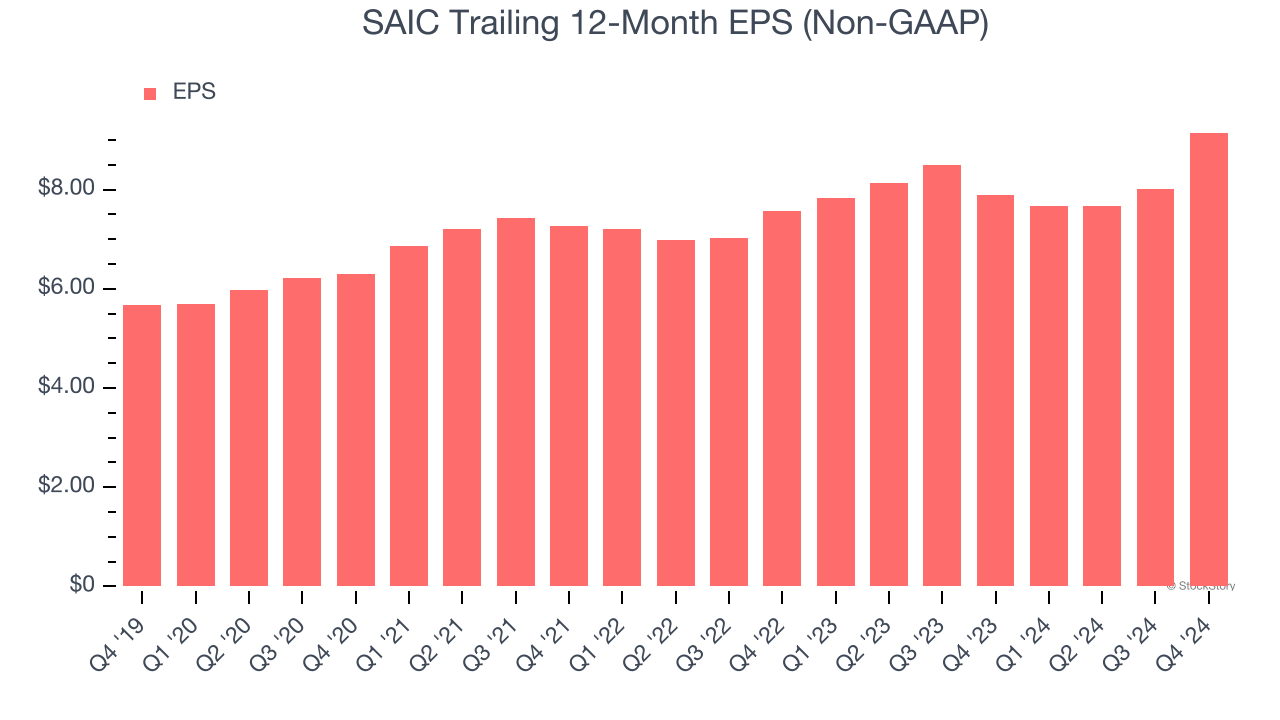

SAIC’s EPS grew at a solid 10% compounded annual growth rate over the last five years, higher than its 3.2% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

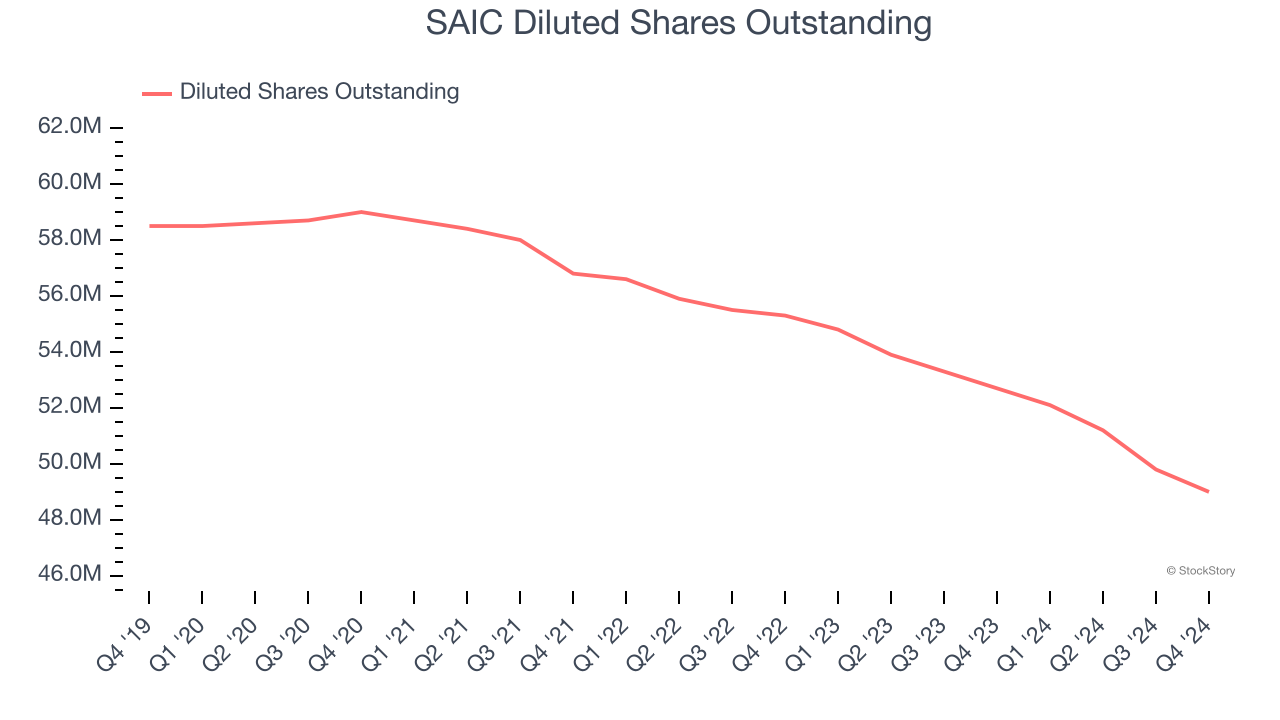

Diving into the nuances of SAIC’s earnings can give us a better understanding of its performance. As we mentioned earlier, SAIC’s operating margin expanded by 2 percentage points over the last five years. On top of that, its share count shrank by 16.2%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

In Q4, SAIC reported EPS at $2.57, up from $1.43 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects SAIC’s full-year EPS of $9.15 to stay about the same.

Key Takeaways from SAIC’s Q4 Results

We were impressed by how significantly SAIC blew past analysts’ EPS expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. Looking ahead, full-year guidance for EBITDA and EPS were both ahead. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 6.7% to $111.50 immediately following the results.

SAIC had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.