Shareholders of Seagate Technology would probably like to forget the past six months even happened. The stock dropped 23.3% and now trades at $84. This may have investors wondering how to approach the situation.

Is now the time to buy Seagate Technology, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Despite the more favorable entry price, we're cautious about Seagate Technology. Here are three reasons why there are better opportunities than STX and a stock we'd rather own.

Why Is Seagate Technology Not Exciting?

The developer of the original 5.25inch hard disk drive, Seagate (NASDAQ:STX) is a leading producer of data storage solutions, including hard drives and Solid State Drives (SSDs) used in PCs and data centers.

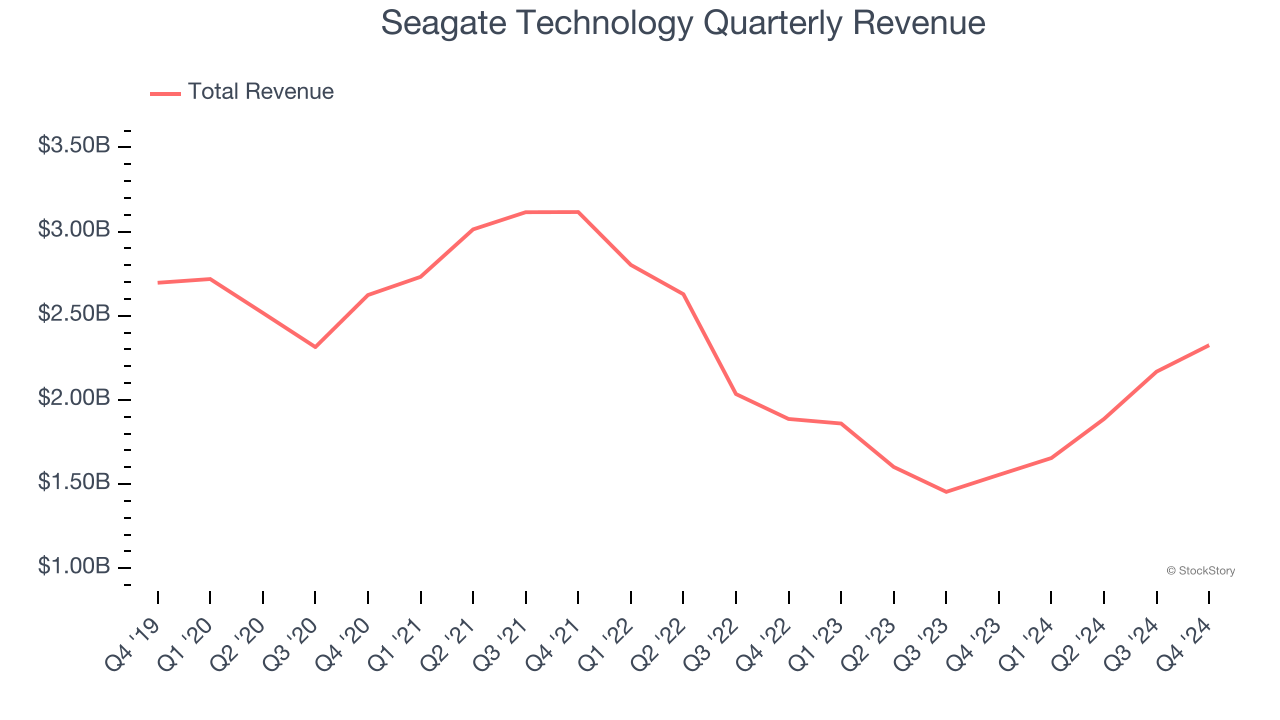

1. Revenue Spiraling Downwards

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Seagate Technology’s demand was weak over the last five years as its sales fell at a 4.2% annual rate. This wasn’t a great result and signals it’s a lower quality business. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

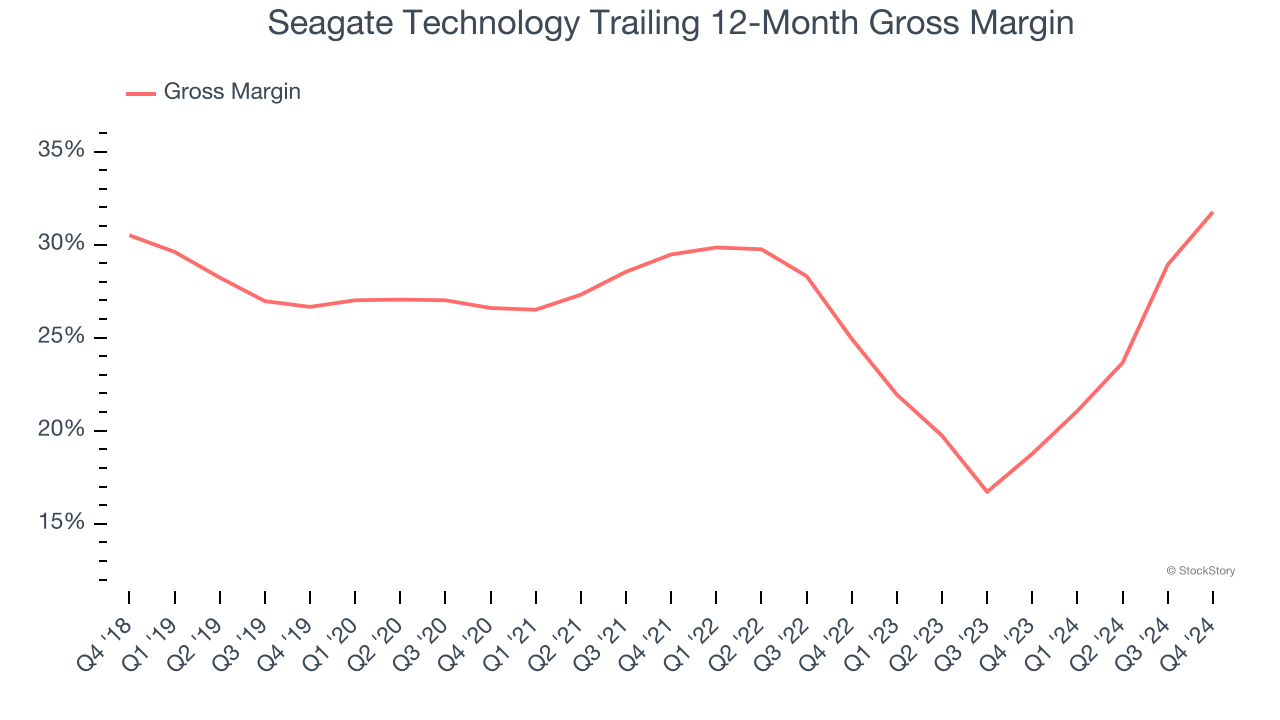

2. Low Gross Margin Reveals Weak Structural Profitability

Gross profit margin is a key metric to track because it shows how much money a semiconductor company gets to keep after paying for its raw materials, manufacturing, and other input costs.

Seagate Technology’s gross margin is one of the worst in the semiconductor industry, signaling it operates in a competitive market and lacks pricing power. As you can see below, it averaged a 26% gross margin over the last two years. Said differently, Seagate Technology had to pay a chunky $74.05 to its suppliers for every $100 in revenue.

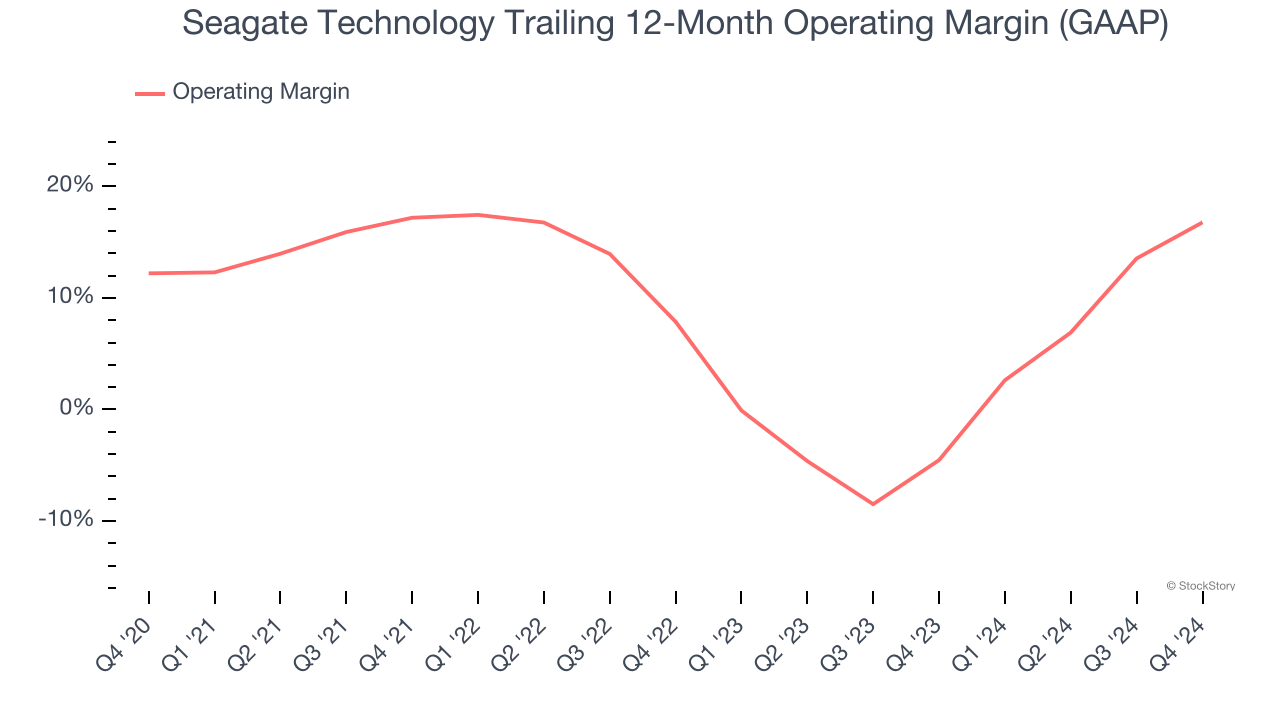

3. Weak Operating Margin Could Cause Trouble

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Seagate Technology was profitable over the last two years but held back by its large cost base. Its average operating margin of 7.3% was weak for a semiconductor business. This result isn’t too surprising given its low gross margin as a starting point.

Final Judgment

Seagate Technology isn’t a terrible business, but it doesn’t pass our bar. After the recent drawdown, the stock trades at 10.3× forward price-to-earnings (or $84 per share). Beauty is in the eye of the beholder, but our analysis shows the upside isn’t great compared to the potential downside. We're fairly confident there are better stocks to buy right now. Let us point you toward one of our top digital advertising picks.

Stocks We Like More Than Seagate Technology

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.