Household products company Church & Dwight (NYSE:CHD) missed Wall Street’s revenue expectations in Q1 CY2025, with sales falling 2.4% year on year to $1.47 billion. Next quarter’s revenue guidance of $1.50 billion underwhelmed, coming in 4% below analysts’ estimates. Its non-GAAP profit of $0.91 per share was 1.4% above analysts’ consensus estimates.

Is now the time to buy Church & Dwight? Find out by accessing our full research report, it’s free.

Church & Dwight (CHD) Q1 CY2025 Highlights:

- Revenue: $1.47 billion vs analyst estimates of $1.51 billion (2.4% year-on-year decline, 3% miss)

- Adjusted EPS: $0.91 vs analyst estimates of $0.90 (1.4% beat)

- Adjusted EBITDA: $356.2 million vs analyst estimates of $361.7 million (24.3% margin, 1.5% miss)

- Revenue Guidance for Q2 CY2025 is $1.50 billion at the midpoint, below analyst estimates of $1.56 billion

- Adjusted EPS guidance for Q2 CY2025 is $0.85 at the midpoint, below analyst estimates of $0.95

- Operating Margin: 20.1%, in line with the same quarter last year

- Free Cash Flow Margin: 12.7%, down from 14.4% in the same quarter last year

- Organic Revenue fell 1.2% year on year (5.2% in the same quarter last year)

- Market Capitalization: $24.45 billion

Rick Dierker, Chief Executive Officer, commented, “In an environment of slowing consumption, our brands are performing well. We continue to drive both dollar and volume share gains across most of our brands. Our balanced portfolio of value and premium products keep us well positioned to navigate this environment.

Company Overview

Best known for its Arm & Hammer baking soda, Church & Dwight (NYSE:CHD) is a household and personal care products company with a vast portfolio that spans laundry detergent to toothbrushes to hair removal creams.

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years.

With $6.07 billion in revenue over the past 12 months, Church & Dwight carries some recognizable products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

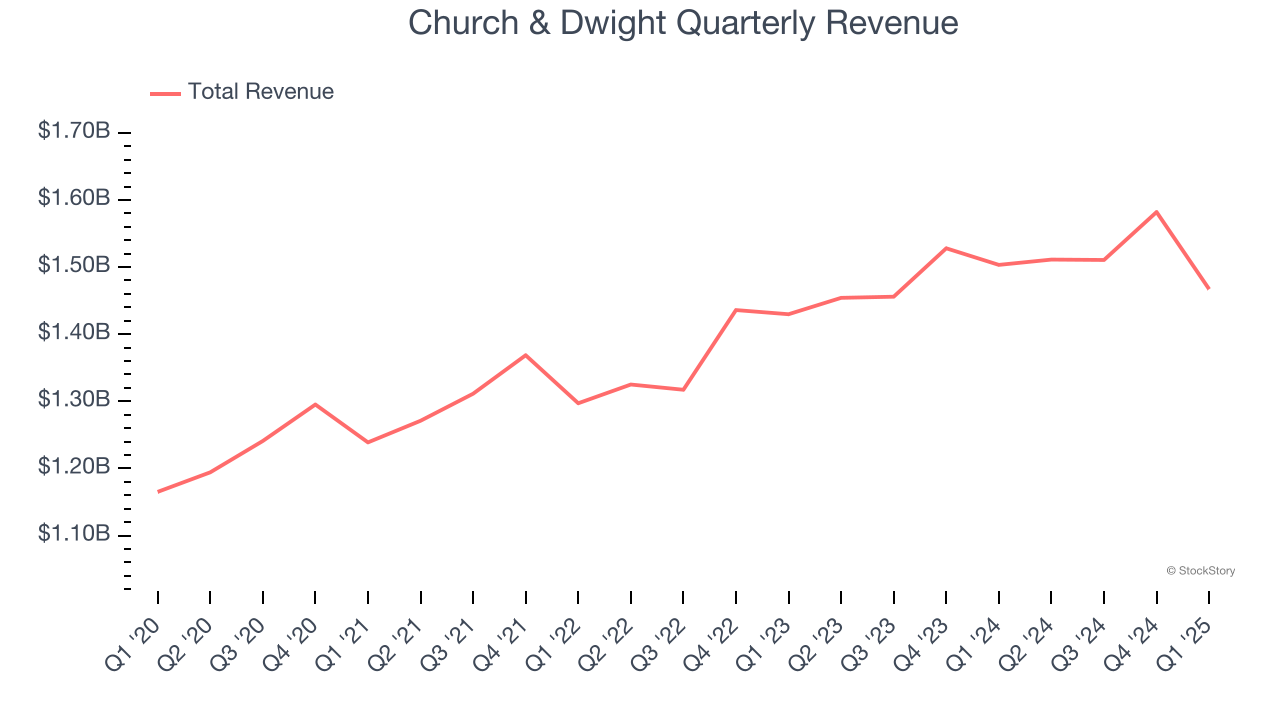

As you can see below, Church & Dwight’s sales grew at a tepid 5% compounded annual growth rate over the last three years, but to its credit, consumers bought more of its products.

This quarter, Church & Dwight missed Wall Street’s estimates and reported a rather uninspiring 2.4% year-on-year revenue decline, generating $1.47 billion of revenue. Company management is currently guiding for a 1% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 4.4% over the next 12 months, similar to its three-year rate. This projection doesn't excite us and suggests its newer products will not catalyze better top-line performance yet.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Organic Revenue Growth

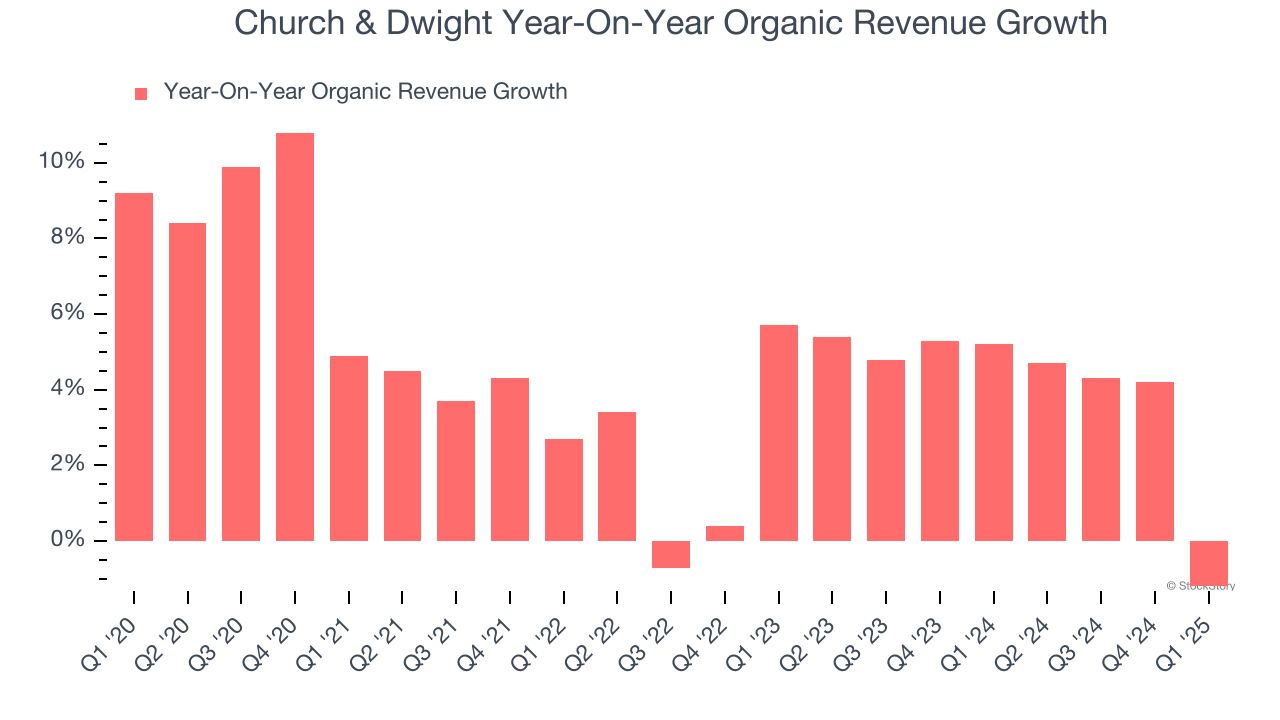

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business’s performance excluding one-time events such as mergers, acquisitions, and divestitures as well as foreign currency fluctuations.

The demand for Church & Dwight’s products has generally risen over the last two years but lagged behind the broader sector. On average, the company’s organic sales have grown by 4.1% year on year.

In the latest quarter, Church & Dwight’s organic sales fell by 1.2% year on year. This decline was a reversal from its historical levels. We’ll keep a close eye on the company to see if this turns into a longer-term trend.

Key Takeaways from Church & Dwight’s Q1 Results

We struggled to find many positives in these results. Its organic revenue missed and its revenue fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 5.1% to $94.10 immediately after reporting.

Church & Dwight underperformed this quarter, but does that create an opportunity to invest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.