iShares China Large-Cap ETF (FXI)

39.35

-0.05 (-0.13%)

NYSE · Last Trade: Jan 11th, 12:28 PM EST

Detailed Quote

| Previous Close | 39.40 |

|---|---|

| Open | 39.25 |

| Day's Range | 39.05 - 39.39 |

| 52 Week Range | 28.41 - 42.00 |

| Volume | 28,496,993 |

| Market Cap | 66.52M |

| Dividend & Yield | 0.8320 (2.11%) |

| 1 Month Average Volume | 27,922,829 |

Chart

News & Press Releases

China’s 295 billion yuan allocation in 2026 will go towards an investment plan for the central government's budget and other major projects.

Via Stocktwits · December 31, 2025

A new 13F filing shows David Tepper's hedge fund betting on regional banks, semiconductors and more.

Via Benzinga · November 13, 2025

Morgan Stanley Chief Ted Pick Proclaims China As Top Draw For Asset Managersstocktwits.com

Via Stocktwits · November 4, 2025

China Services Activity Grows At Rapid Pace — Profit Margins Remain A Concernstocktwits.com

Via Stocktwits · September 3, 2025

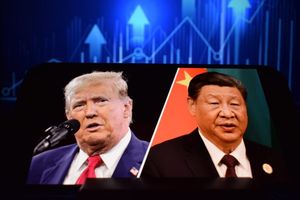

World Faces ‘Peace Or War’: China's Xi Issues Stark Warning As Trump Cries Conspiracy Against USstocktwits.com

Via Stocktwits · September 2, 2025

China Almost Turns Off the Tap On US Energy Imports Ahead Of Crucial Trade Meetstocktwits.com

Via Stocktwits · July 24, 2025

Markets dipped as Trump and Xi's trade truce underwhelmed investors, with tech stocks like Meta and Chinese ADRs sliding on Thursday.

Via Benzinga · October 30, 2025

Overseas Markets Outperforming Please click here for a chart of SPDR S&P 500 ETF Trust (NYSE:

Via Benzinga · October 27, 2025

Wall Street's relentless rally came to an abrupt halt Friday as President Donald Trump's renewed tariff threats to China sent investors fleeing risk assets, triggering the biggest volatility spike in months and wiping out hundreds of billions

Via Benzinga · October 10, 2025

The stock market stumbled Friday after President Donald Trump threatened a sweeping increase in tariffs on Chinese imports, sending equity indices and risk sentiment sharply lower. • AMD shares are retreating from recent levels. See what is driving the move here.

Via Benzinga · October 10, 2025

Qualcomm and Google Cloud have expanded their relationship to help automakers deliver enhanced in-car experiences through agentic AI.

Via Benzinga · September 18, 2025

China-focused ETFs gain momentum as trade talks and a weaker USD shift investor sentiment. KWEB ETF up 30% YTD. KraneShares sees potential for growth in China's new economy industries and offers thematic funds like KWEB, KARS, and more. Other options include FXI, GXC, and CHIQ. China's policies fuel the trend.

Via Benzinga · August 27, 2025

Till July, the total profits of industrial enterprises fell 1.7%, compared with the first seven months of last year.

Via Stocktwits · August 27, 2025

David Tepper sold casino stocks and bought airline stocks in the second quarter. Here's a look at the changes made to the Appaloosa hedge fund.

Via Benzinga · August 15, 2025

The KraneShares CSI China Internet ETF and the iShares MSCI China ETF are garnering renewed investor interest.

Via Benzinga · August 15, 2025

Billionaire hedge fund manager Paul Tudor Jones has made several notable portfolio moves during the second quarter of 2025.

Via Benzinga · August 15, 2025

July retail sales and industrial output grew less than expected.

Via Stocktwits · August 15, 2025

Bridgewater Associates exits holdings in US-listed Chinese companies amidst geopolitical tensions, shifts focus to US tech stocks.

Via Benzinga · August 14, 2025

Chinese stocks jumped as Beijing launched loan subsidies to boost spending, and following Trump's tariff truce extension.

Via Benzinga · August 13, 2025

Chinese tech and EV stocks surged on Wednesday on news of a 90-day trade truce between US and China, boosting hopes for improved economic ties.

Via Benzinga · August 13, 2025

According to data from China’s National Bureau of Statistics, the purchasing manufacturing index (PMI) slipped to 49.3 in July, compared with 49.7 in June.

Via Stocktwits · July 31, 2025

In July, China's four largest onshore gold-backed ETFs experienced a combined net outflow of approximately 3.2 billion yuan ($450 million), according to a Bloomberg News report.

Via Stocktwits · July 29, 2025

There’s a risk of additional economic damage if the U.S. President’s moves discourage other countries from conducting trade with Beijing.

Via Stocktwits · July 22, 2025

Chinese large-cap stocks are beating the S&P 500 by the widest margin since 2009, led by Xiaomi's explosive rally in 2025.

Via Benzinga · July 21, 2025