General Motors (GM)

69.06

+0.39 (0.58%)

NYSE · Last Trade: Oct 31st, 3:44 PM EDT

Toronto, ON – October 31, 2025 – The Canadian Dollar (CAD), affectionately known as the "loonie," has recently experienced a significant weakening against major global currencies, particularly the U.S. Dollar. This faltering is largely attributed to a confluence of factors: a discernible slowdown in Canada's domestic economic growth and a persistently

Via MarketMinute · October 31, 2025

The automaker's stock is suddenly popping due to strong results and a rosier outlook.

Via The Motley Fool · October 30, 2025

GM share price has staged a strong surge to a record high.

Via Talk Markets · October 30, 2025

In a financial landscape increasingly characterized by volatility and a relentless pursuit of growth, two ancient commodities, gold and copper, are re-emerging as unexpected titans, powering significant returns for investors. Gold, the perennial safe haven, has shattered records, surging past unprecedented price points, while copper, the indispensable industrial metal, has

Via MarketMinute · October 30, 2025

In a landmark development poised to redefine global financial landscapes, a tentative trade truce between the United States and China, formalized around October 30, 2025, has injected a much-needed dose of cautious optimism into international stock markets. This de-escalation, following years of escalating tariff battles and geopolitical friction, represents a

Via MarketMinute · October 30, 2025

Global stock markets are navigating a landscape of cautious optimism following the recent US-China trade truce announced on October 30, 2025. This significant development, emerging from high-level discussions between US President Donald Trump and Chinese President Xi Jinping at the APEC Summit in Busan, South Korea, has introduced a temporary

Via MarketMinute · October 30, 2025

GM To Reportedly Lay Off Employees At Detroit, Tennessee And Ohio Amid EV Demand Slowdownstocktwits.com

Via Stocktwits · October 29, 2025

In a groundbreaking move set to redefine the accessibility of precious metals, MMTC-PAMP, India's only London Bullion Market Association (LBMA) accredited gold and silver refiner, has forged a strategic partnership with quick-commerce giant Swiggy Instamart. This collaboration introduces an unprecedented service: the 10-minute delivery of pure gold and silver coins

Via MarketMinute · October 30, 2025

BUSAN, South Korea – In a development poised to send ripples across global financial markets, US President Donald Trump and Chinese President Xi Jinping today announced a significant trade truce on the sidelines of the Asia-Pacific Economic Cooperation (APEC) Summit. The agreement, coming after months of escalating tensions and tariff battles,

Via MarketMinute · October 30, 2025

As of late October 2025, the global automotive industry finds itself in a precarious yet transformative period, where its very pulse—from daily production lines to groundbreaking technological leaps—is dictated by the intricate world of semiconductor manufacturing. These minuscule yet mighty chips are no longer mere components; they are the digital sinews of modern vehicles, underpinning [...]

Via TokenRing AI · October 30, 2025

The global semiconductor supply chain, a complex web of design, fabrication, and assembly, finds itself once again at the precipice of a major crisis, this time fueled less by pandemic-driven demand surges and more by escalating geopolitical tensions. As of late October 2025, a critical dispute involving Dutch chipmaker Nexperia has sent shockwaves through the [...]

Via TokenRing AI · October 30, 2025

Strattec Security (STRT) surges into top 10% momentum, long-term uptrend confirmed. GM, Ford, Stellantis supplier primed for breakout.

Via Benzinga · October 30, 2025

GM lays off nearly 3,400 workers at EV facilities across Ohio, Michigan and Tennessee amid EV low demand in the US.

Via Benzinga · October 30, 2025

Major U.S. companies are announcing mass layoffs: Amazon (~30,000), GM (~3,300), Target (~1,800), and UPS (~48,000), signaling a cooling job market and growing economic uncertainty.

Via Talk Markets · October 29, 2025

Despite a series of recent interest rate cuts by major central banks across the globe, the anticipated significant drop in mortgage rates has largely failed to materialize. As of October 2025, homeowners and prospective buyers are grappling with stubbornly elevated borrowing costs, a phenomenon that is sending ripples of concern

Via MarketMinute · October 29, 2025

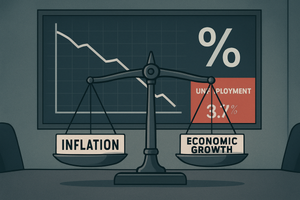

As the closing bell rang on October 29, 2025, financial markets grappled with the implications of the Federal Reserve's latest monetary policy adjustments. For the second time this year, the Fed opted to cut its benchmark interest rate by 25 basis points, bringing the federal funds rate to a target

Via MarketMinute · October 29, 2025

Washington D.C. – October 29, 2025 – In an unprecedented move that sent ripples through global financial markets, the Federal Reserve today announced a 25-basis-point cut to its benchmark federal funds rate, lowering it to a target range of 3.75%-4.00%. This decision, the second such reduction this year,

Via MarketMinute · October 29, 2025

In a closely watched decision, the Federal Open Market Committee (FOMC) of the U.S. Federal Reserve today, October 29, 2025, announced a cut to its benchmark interest rate, lowering the target range by 25 basis points to 3.75%-4.00%. This move marks the second rate reduction by

Via MarketMinute · October 29, 2025

Washington D.C. – October 29, 2025 – In a pivotal move signaling a significant shift in monetary policy, the U.S. Federal Reserve's Federal Open Market Committee (FOMC) today announced a cut in its benchmark interest rate by 25 basis points, bringing the new target range to 3.75%-4.00%

Via MarketMinute · October 29, 2025

The world is on the cusp of a monumental energy transformation, and at the heart of this shift lies a foundational metal: copper. Global demand for copper is experiencing an unprecedented surge, primarily driven by the accelerating transition to green energy and the broader push towards electrification. This surge is

Via MarketMinute · October 29, 2025

October 2025 proved to be a pivotal month for the global battery industry, characterized by a complex interplay of geopolitical strategy, technological innovation, and significant shifts in supply chain dynamics. From the unexpected collapse of a major battery component plant in Michigan to a landmark critical minerals deal between the United States and Australia, and [...]

Via TokenRing AI · October 29, 2025

The global economic landscape as of late October 2025 presents a nuanced picture of moderate growth, persistent inflation, and evolving geopolitical dynamics. While the US stock market has surged to unprecedented highs, primarily fueled by a booming artificial intelligence (AI) sector and robust corporate earnings, it remains intricately linked to

Via MarketMinute · October 29, 2025

We discuss how cloud outages may impact stocks beyond Amazon. Plus, GM's great results may show how weak EV sales will be in the U.S. and the how co-CEO roles have become so popular in tech.

Via The Motley Fool · October 29, 2025

The U.S. job market is exhibiting undeniable signs of a significant slowdown, a trend that is profoundly influencing the Federal Reserve's monetary policy trajectory. Recent data, as of October 28, 2025, points to a substantial cooling, with job growth figures being revised downwards and unemployment ticking upwards. This shift

Via MarketMinute · October 28, 2025

The financial world is holding its breath as the Federal Reserve convenes its Federal Open Market Committee (FOMC) meeting on October 28-29, 2025. Market participants and economists alike are anticipating a highly probable second consecutive interest rate cut, a move that signals the central bank's growing concern over a softening

Via MarketMinute · October 28, 2025